Many financial services firms, including banks, insurance companies, and capital markets, struggle to stand out in the field due to high competition. It is challenging for them to differentiate themselves from their rivals because the product is simple to copy.

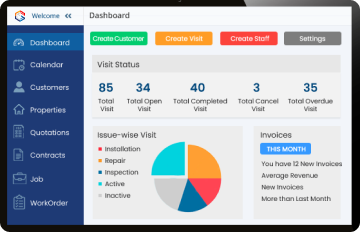

Several businesses have realised that they need to improve their customer relationship experience to gain a competitive edge and attract more clients. A company can enhance client retention, become more competitive, and boost profitability by deploying a Finance CRM Software solution that offers all the required financial services features.

Benefits of CRM in Financial Services

Financial service companies must keep a strong relationship with their clients if they want to survive in the cutthroat marketplace of today. This is where you should utilise effective Customer Relationship Management software to achieve this.

Below, we have curated some significant benefits of using CRM systems in financial services:

Customer Experience

The main objective of CRM in the financial services industry is to provide consumers with a remarkable experience. The purpose of offering customised services entails understanding their wants, tastes, and habits. Businesses better understand their consumers’ wants and provide suitable products and services by collecting customer data at numerous touch points. Increasing client happiness and loyalty are the results of this.

Businesses may track client interactions and complaints with CRM, which helps them respond to problems quickly and successfully. By taking a proactive approach, businesses may help customers feel appreciated and return for more of their products and services.

Better Customer Retention

Having a new customer is both time and money-consuming. By providing individualised services and raising customer satisfaction, CRM Software for Financial Services can assist firms in keeping their existing consumers. Businesses may identify clients who are likely to leave and take proactive steps to keep them by employing data analytics.

CRM can assist firms in upselling and cross-selling goods and services to current clients. Businesses may find the best products and services for each consumer and provide them with customised offers by analysing customer data. Increased customer loyalty and more revenue per customer may result from this.

Read More: You Should Know About the Significant Benefits of CRM in Healthcare

Improved Sales & Marketing

Businesses can boost efficiency and productivity by streamlining their sales and marketing processes with Customer Relationship Management. Businesses can determine and target the most lucrative consumer segments with tailored marketing efforts by evaluating customer data. This may aid in boosting marketing campaign response and conversion rates, resulting in more income and sales.

CRM help organisations in tracking leads and opportunities, allowing sales teams to focus their efforts and close deals more quickly. It also allows sales teams to make more tailored and successful sales presentations by giving them access to real-time customer data and insights.

Improved Collaboration & Communication

CRM helps organisations in enhancing teamwork and communication among various departments and teams. This will make it possible for staff members from many departments to access and exchange client data by centralising it. Customer service and sales operations may become more integrated and more successful as a result.

CRM can also assist companies in automating routine tasks and workflows, giving staff members more time to focus on higher-value duties. This will increase the productivity and efficiency of the organisation!

Enhanced Data Security

Data compliance and security are crucial aspects of the financial services sector. CRM offers a centralised system for handling customer data, which can assist firms in maintaining data security and complying with regulatory standards. Businesses can make sure that client data is secure and protected by limiting access to it and monitoring user behaviour.

CRM can also assist firms in complying with legal requirements by giving organisations tools for managing consumer preferences and consent. Businesses may maintain compliance and build trust with their clients by allowing customers to regulate how their data is used.

Conclusion

Investing in a CRM system is essential for financial service providers who want to succeed in today’s competitive market. CRM systems help businesses to gain a competitive advantage and grow their business. So, before selecting the CRM system for your business, you have to understand your requirements. This will help you to find the right CRM software!

Texas Soft Solutions provide CRM Software for Financial Services that ensure improved performance, boosts productivity, and improves the client experience. Our software improves your relationship with current clients while effortlessly bringing in new ones. If you want to know more about the software, you can book a free trial session.